Risk analysis and risk management are integral parts of any business strategy. They involve identifying, assessing, and controlling threats to an organization’s capital and earnings.

These threats or risks could stem from a variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents, and natural disasters.

Definitions

Risk Analysis: This process helps identify and assess potential threats that could harm an organization. It provides a way to understand the implications of possible risks and how they can impact the business.

Risk Management involves identifying, assessing, and controlling risks and developing strategies to manage them effectively.

These strategies could include transferring the risk to another party, avoiding the risk, reducing the negative effect of the risk, and accepting some or all of the consequences of a particular risk.

10 Characteristics of Risk Analysis and Risk Management

- Proactive Approach: Risk analysis and management are proactive, not reactive. They identify potential strengths, weaknesses and risks before they occur.

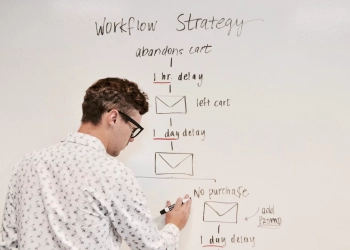

- Systematic: They follow a systematic process of identifying, assessing, and responding to risk, such as SWOT Analysis.

- Based on Best Available Information: They use the best available information to assess potential risks.

- Inclusive: They involve all stakeholders in the process.

- Dynamic: They are continuously updated as new information becomes available.

- Considers Uncertainty: They acknowledge that not all risks can be identified or accurately assessed.

- Transparent: The process, assumptions, and decision-making are documented and can be reviewed by all stakeholders.

- Adaptable: They can be adapted to changing circumstances.

- Considers Human Factors: They consider the impact of human error, biases, training needs, and decision-making.

- Strategic: They align with the organization’s objectives and help achieve them.

Features, Benefits, and Challenges with Risk Analysis and Risk Management

Features

- Identification of potential risks.

- Assessment of the impact and likelihood of risks.

- Development of risk management strategies.

- Implementation of risk management strategies.

- Monitoring and review of risks and risk management strategies.

Benefits

- Improved decision-making.

- Increased likelihood of achieving business objectives.

- Protection of assets and people.

- Compliance with legal and regulatory requirements.

- Enhanced reputation and stakeholder confidence.

Challenges

- Difficulty in identifying all potential risks.

- Uncertainty in assessing the impact and likelihood of risks.

- Resistance to change in implementing risk management strategies.

- Cost and resource implications of risk management.

Tips and Techniques around Risk Analysis and Risk Management

- Involve All Stakeholders: Ensure all relevant stakeholders are involved in the risk analysis and management.

- Use a Risk Matrix: A risk matrix can help assess the impact and likelihood of risks.

- Prioritize Risks: Not all risks are equal. Prioritize them based on their potential impact and likelihood.

- Develop a Risk Management Plan: Document your risk management strategies in a plan.

- Review and Update Regularly: Risks and risk management strategies should be reviewed and updated regularly.

5 Examples of Risk Analysis and Risk Management at Work

- Financial Services: Banks use risk analysis and management to assess the risk of default on loans and to manage their investment portfolios.

- Healthcare: Hospitals use risk analysis and management to identify potential patient safety risks and develop strategies to mitigate these risks.

- Construction: Construction companies use risk analysis and management to identify potential safety hazards and to develop strategies to prevent accidents.

- IT: IT companies use risk analysis and management to identify potential cybersecurity threats and to develop strategies to protect their systems and data.

- Manufacturing: Manufacturing companies use risk analysis and management to identify potential risks to production and to develop strategies to ensure continuity of supply.

Conclusion

Risk analysis and risk management are essential for any organization.

They help identify, assess, and manage potential risks, improving decision-making, job analysis, protecting assets and people, and increasing the likelihood of achieving business objectives.

Despite the challenges, the benefits of practical risk analysis and management far outweigh the costs.